2025 European Housing Trend Report: Insights from 20,000+ Voices Across Europe

To understand where Europe’s housing market is going, start with how people feel about where they live. That’s the basis of the 2025 REMAX European Housing Trend Report, a survey of more than 20,000 adults across 23 countries revealing how satisfaction, affordability, and shifting priorities are reshaping housing decisions across Europe. Whether you’re buying your first home, selling a property, or considering a move abroad, this report provides the market intelligence you need to make informed decisions. Read on to see what over 20,000 Europeans revealed about the homes they love, the challenges they face, and the forces shaping how—and where—we’ll live next.

Download the full report

The satisfaction scorecard: Who’s happy at home?

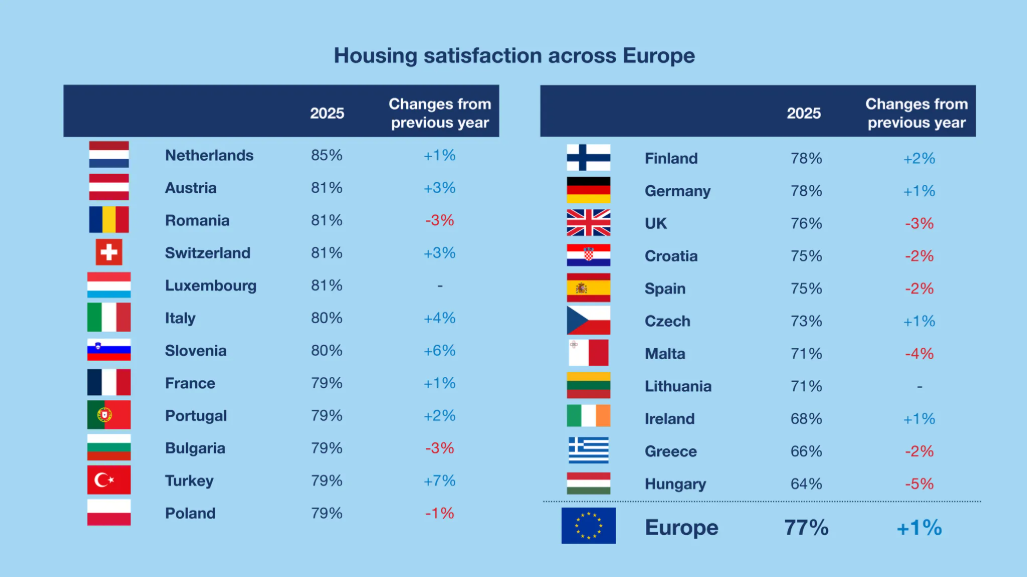

Across Europe, 77% of people are satisfied with their current housing situation, but that average masks striking differences. The older you are, the more settled you tend to feel: satisfaction reaches 84–93% among Baby Boomers (aged 61-79) and the Silent Generation (aged 79-97), while Millennials (aged 29-44) and Gen Z (aged 13-28) trail behind at around 73%.

Where you live also makes a difference. Residents of smaller towns and villages report higher contentment, suggesting that space, and perhaps a slower pace, adds to happiness. Homeowners remain far more satisfied than renters, and the top complaints among the unhappy are lack of space (37%) and affordability pressures (34%).

Data snapshot: See how all 23 nations compare in satisfaction, from the Netherlands at 85% to Hungary at 64%, and discover which age groups feel most at home.

Owners, renters, and the barriers between them

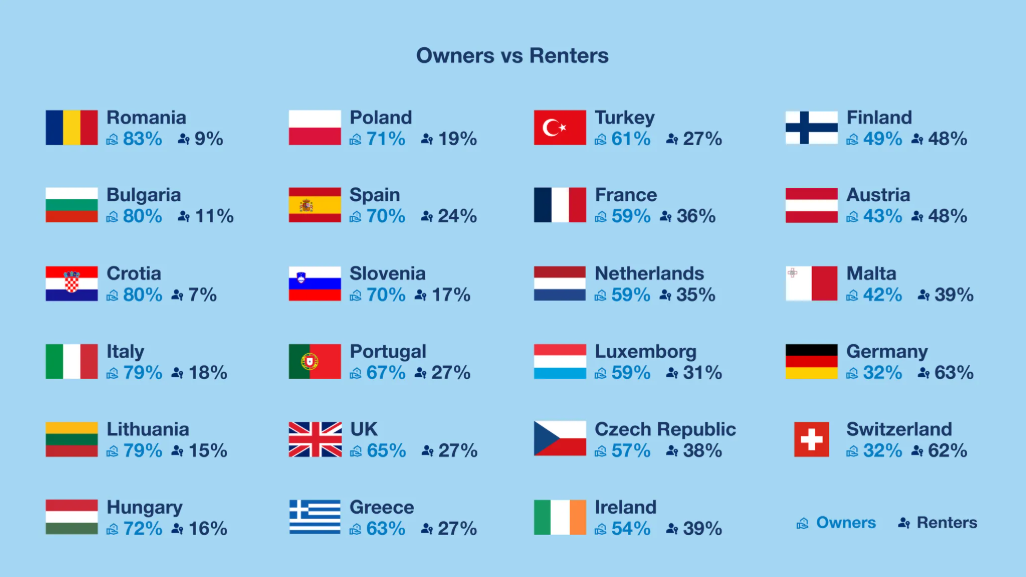

Europe is overwhelmingly a homeowner’s market. Nearly two-thirds (69%) of survey respondents own their homes, while just 29% rent. But dig into the national data and the picture shifts dramatically. In Germany and Switzerland, renters are the majority, while in Romania and Bulgaria, home ownership is almost universal.

For many, the path to ownership is steep. Women are more likely to cite insufficient salaries as the main obstacle, while men point to limited government support. But not everyone is locked out by cost. For some, the decision not to buy is intentional: around 15% of Europeans say they prefer the flexibility of renting. And even for those who do own, keeping up with costs brings its own challenges.

Data snapshot: Across Europe, homeowners report 85% housing satisfaction compared to 61% among renters, a 24-point gap that highlights the enduring appeal of ownership.

Balancing affordability and aspiration

Owning a home remains an ambition across Europe, but affordability continues to test it. Over a third of Europeans say their housing is too expensive, with costs consuming about 32% of monthly income on average, and far more for single households. Nearly one in four spend over 40% of their income on housing, and 12% spend more than half.

The story doesn’t end with mortgages or rent. Even after the energy crisis has eased, utility costs remain significantly higher than before the pandemic. While 45% of Europeans say they can manage their energy bills comfortably, 16% are struggling, and that strain shapes daily comfort and confidence at home.

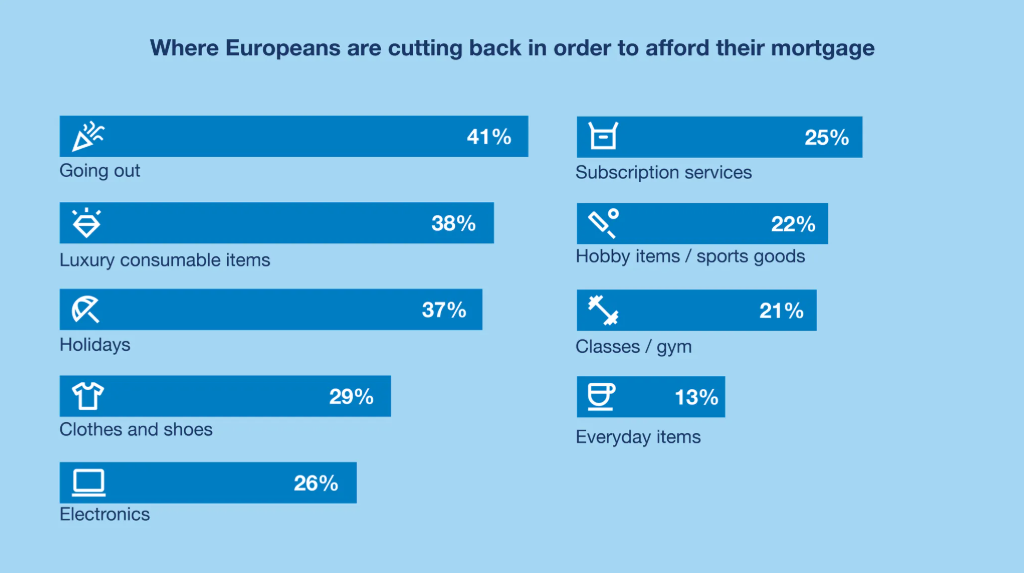

Behind the statistics is a story of trade-offs. Three in four Europeans with mortgages say they’ve reduced spending to meet their payments, and what they’re cutting reveals priorities and pain points. At the top of the list: nights out, cinema trips, and leisure activities, followed closely by holidays. These sacrifices are prompting some Europeans to rethink not just how they live—but where.

Data snapshot: Energy stress divides the continent: 79% of Dutch households feel comfortable with their bills, compared to just 16% in Greece.

Europe on the move

Europeans, it turns out, are mostly staying put—at least in the short term. Only 17% of people expect to move in the next year, but that figure rises sharply among Gen Z and renters. When people do plan to move, their motivations vary: renters are chasing better quality housing, while homeowners primarily want more space in their next home.

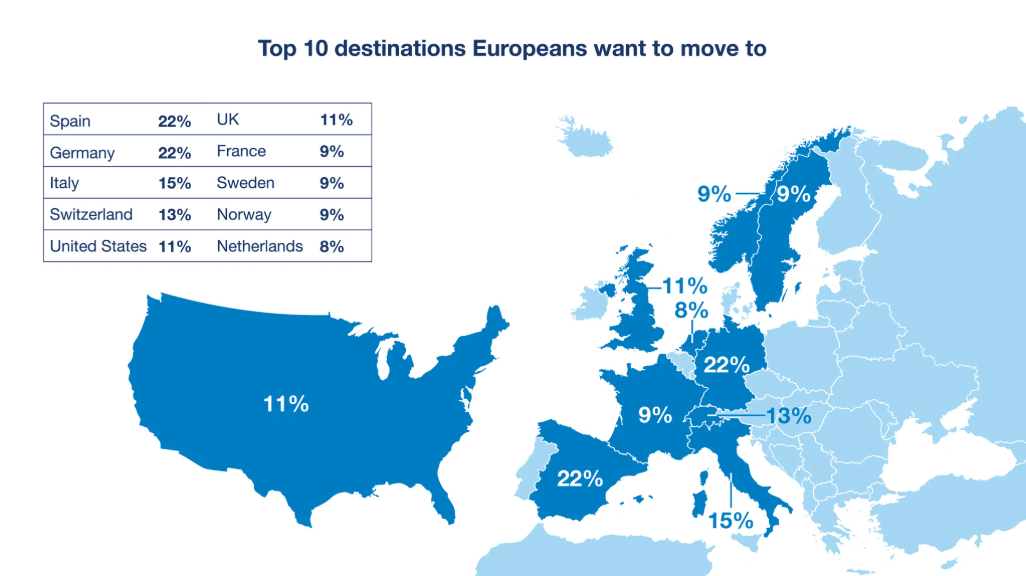

However, a surprising number of those looking to relocate aren’t just dreaming about the next neighborhood, they’re dreaming about the next country. Nearly one in three Europeans would consider moving abroad for a better quality of life. Spain and Germany top the list of preferred destinations, followed by Italy and Switzerland—proof that the idea of “home” is as much about lifestyle as location.

Data snapshot: Spain and Germany tie as Europe’s most desired relocation destinations (22% each), with Italy close behind at 15%.

The people we live with: How households shape satisfaction

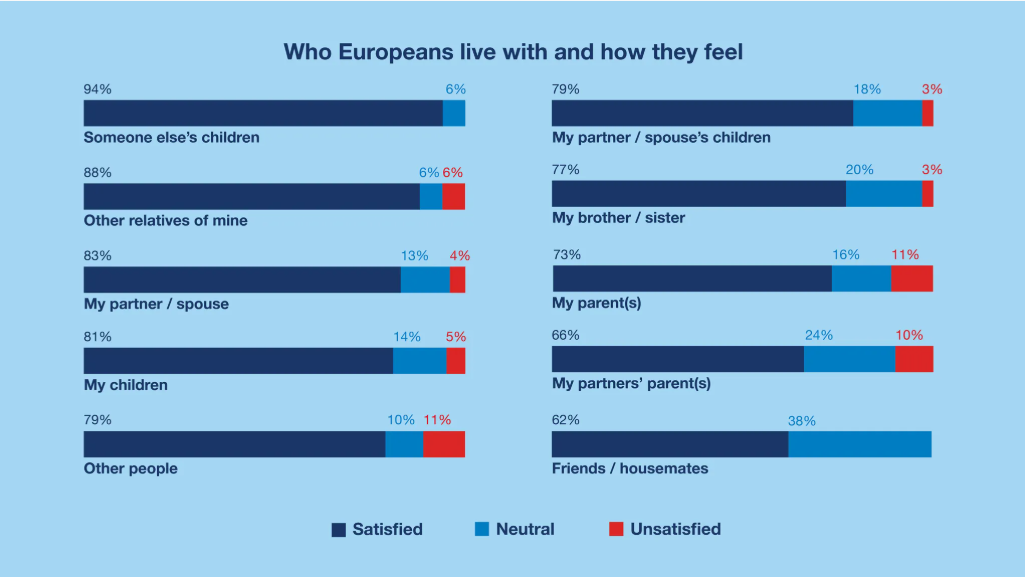

Who you live with matters almost as much as where you live. Europeans who live with a partner or spouse report the highest satisfaction, while single-person households and shared arrangements often face greater financial pressure. Among non-buyers, 10% say not having a partner is a key barrier to purchasing—a reminder that relationship status can influence access to ownership.

Leaving the family home looks very different across Europe. Finns move out earliest, on average at 21, while Spaniards stay the longest, often until 26. Affordability plays a major role, but so do culture and family structure. For many, living with parents is a necessity: 43% of those still at home say they simply can’t afford to move out, and 26% stay to care for relatives.

Data snapshot: Across Europe, 59% live with a partner, 19% live alone, and 12% still live with parents—each arrangement linked to distinct levels of satisfaction and independence.

Europe’s open door: How comfortable are we with hosting?

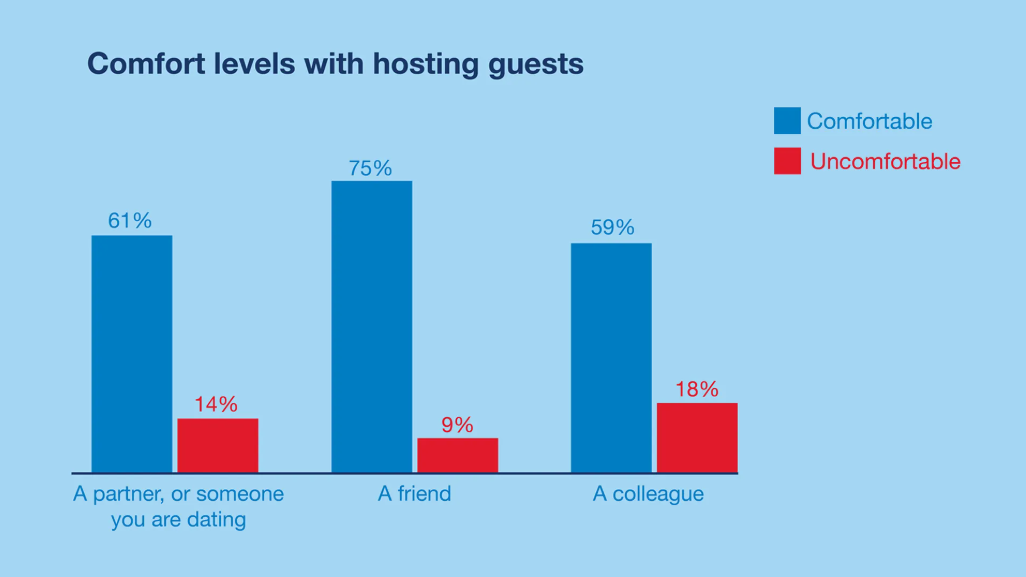

Here’s a question that reveals more than you might expect: who would you feel comfortable inviting into your home? The answer, it turns out, depends on who they are, and where you live. Three in four Europeans (75%) feel comfortable inviting friends home, but that drops to 61% for partners or dates and 59% for colleagues. The similarity between personal and professional guests hints that confidence in one’s home—not just the relationship—defines how open our doors really are.

Data snapshot: Three in four Europeans (75%) say they’re comfortable inviting friends home, compared to 61% for dates, and 59% for colleagues, revealing how satisfaction translates into social confidence. and Germany tie as Europe’s most desired relocation destinations (22% each), with Italy close behind at 15%.

Beyond the averages: What the country pages reveal

The European overview tells one story, but housing realities are ultimately local. Each of the 23 country chapters in the report uncovers how national economies, cultural attitudes, and family traditions shape the way people live.

Take Italy for example: 80% of Italians are satisfied with their homes, one of Europe’s highest rates, but more than a third would consider moving abroad for a better quality of life. Family plays a central role in Italy’s housing story, with 72% of buyers receiving financial support to purchase property. The report also shows that Italians tend to reach home ownership and independence later in life, and move in with partners more slowly than the European average.

Your next move starts here

From satisfaction to sacrifice, and from affordability to dreams, the 2025 European Housing Trend Report reveals how people across Europe are redefining what “home” means in changing times. Explore the full report to access country-by-country comparisons and exclusive charts which explain not just where the market stands today but also where it’s heading next.

Română

Română

Rusă

Rusă

Engleză

Engleză